8th CPC salary calculator: Estimate the real increase after taxes and deductions.

Wondering how much your salary will increase after the implementation of the 8th CPC? Calculate it right away with our web app.

8th Central Pay Commission (CPC) Salary Calculator

Central Government employees, select your current Pay Level, allowances, HRA, TA, etc. and adjust the Fitment Factor to instantly calculate the corresponding 8th CPC salary, applicable from 2026. You can also edit deductions to view the approximate In-Hand Salary after TDS.

Expected Gross Salary (8th CPC): ₹0.00

Tax Breakdown

Final Taxable Income: ₹0.00

Annual Tax: ₹0.00

Monthly Tax: ₹0.00

Effective Tax Rate: 0%

In-Hand Salary: approx. ₹0.00

Breakdown: Gross - TDS and Deductions

This calculator estimates TDS and In-Hand Salary assuming NPS contributions and the 2025-2026 tax regime.

Treatment of UPSS (Unified Pension Scheme) and specific employer deductions may vary.

Final salary and tax values may differ based on individual employment terms and tax filing.

We also have calculators to find the updated 8th CPC pensions, expected fitment factor, generate dynamic pay matrix tables, and more – based on historical pay commission data and assumptions. Scroll down to try them all.

Table of Content

How to use our 8th pay commission salary calculator?

Government employees in India have another reason to celebrate the New Year 2025 with the 8th CPC coming as a special gift for them. The official confirmation of the 8th Pay Commission formation is here, announced by the Prime Minister. Although, the recommendations of the 8th Pay Commission, especially the fitment factor will come into light only in 2026, we can use an online calculator like ours to estimate your potential increase in salary.

As a Central Government employee, most of you may already be familiar with the input fields used in the calculator, but you can go through the following table if you want to quickly revisit any of the terms.

| Calculator Input fields | Definition |

|---|---|

| Basic Pay | Enter your current basic pay as per the pay matrix (refer salary slip). If you are a new employee and haven’t received any increments, simply select your entry level, such as Level 4, and the basic pay (7th CPC) will be auto-populated. |

| Fitment Factor | A fitment factor is a multiplier used to calculate the revised salary by adjusting the existing basic pay; for example, if the basic pay is ₹10,000 and the fitment factor is 1.96, the new basic pay would be ₹10,000 × 1.96 = ₹19600. |

| HRA | For HRA, select the City Classification X, Y, or Z for the calculator will show the corresponding HRA percentage. We’re using the most recent HRA rates from the 7th CPC, updated when DA exceeded 50% in 2024. |

| DA Percentage | The DA percentage in the 8th Pay Commission Calculator is intentionally set to zero because, once the DA gets integrated into the basic pay using the fitment factor, the immediate rate will be zero. However, you can customize it if needed. |

| TA and DA on TA | Choose the city classification to adjust the TA rates applicable to your role and place of work. As TA also has a DA component to offset inflation, and since the DA will be amalgamated into the new basic pay, the DA on TA is set to 0. |

| Allowances | Allowances depend on the cadre. For example, in the military, you have MSP, Siachen allowance, etc., while in nursing, you have Nursing allowance. Combine the allowances you are currently receiving and enter the total value in the calculator. The default allowance is ₹9,000, but you can customize it based on your actual allowances. These allowances may be revised by the 8th CPC, but for now, enter what you currently receive. |

| Qualification Pay | Certain departments of the government offer qualification pay for employees who are overqualified for their positions, such as holding graduate degrees or PhDs. It is subjective and varies from person to person, so we have provided an input field for you to add it. Though default value is ₹3,000, you can set it to zero if it doesn’t apply to you. |

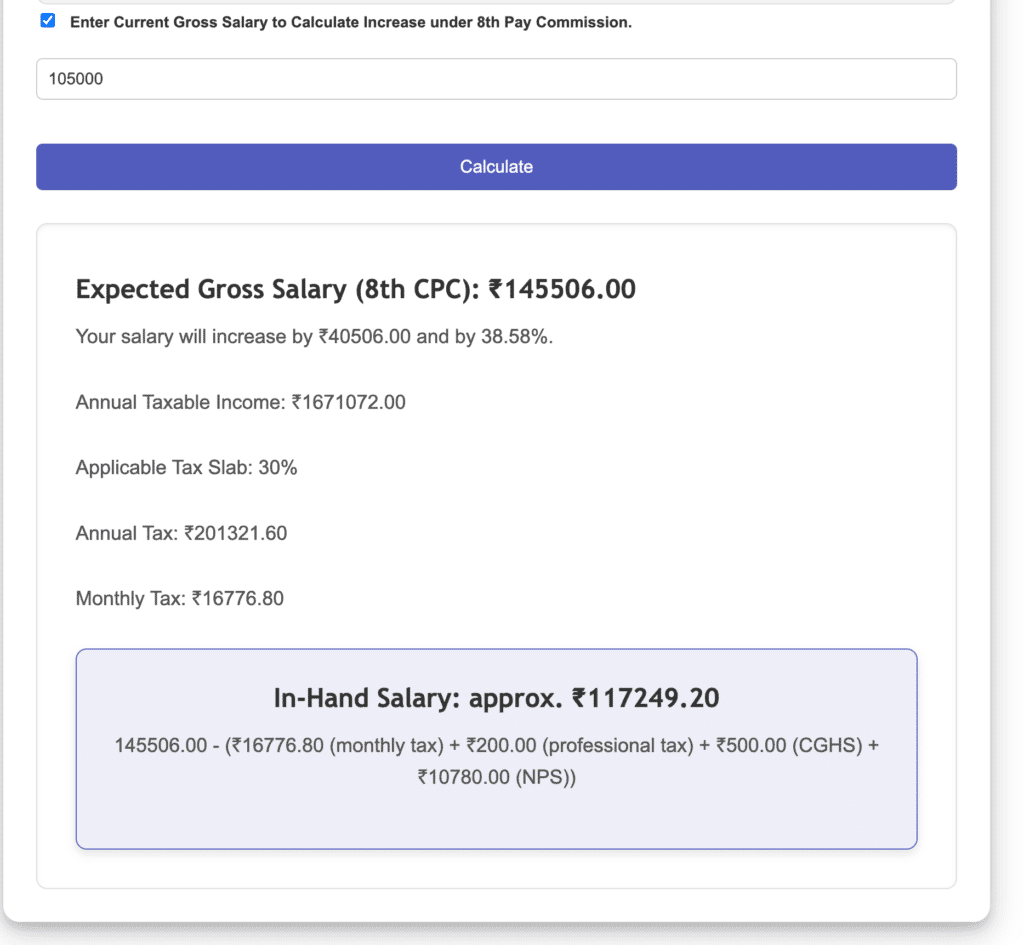

| Increase in salary checkbox | If you want to see how much your salary is going to increase after the 8th Pay Commission, check this box and enter your current gross salary. The web app will show you the amount and percentage in the results section, real-time. |

| Deductions | In-hand salary is calculated after adjusting deductions like TDS, CGHS, NPS, and Professional Tax. We’ve added tax rates applicable in 2026 (new regime) as default in the app, and the slab rates are hard-coded. |

All you need to do is adjust the default data in the calculator based on the values applicable to you, the results will be populated instantly.

Example salary calculation for Central Government employees under 8th Pay Commission.

Fitment factor is the most important and deciding part of of the 8th CPC calculation, and it will be finalised only by 2026. Hence, for the time being, we can choose something in the range between 1.5 to 3.0 ( we have selected 1.9 in the calculator). Now, multiply the chosen fitment factor with the current Basic Pay.

For example, take the case of a Level 7 government employee who is currently in the 4th stage of the pay matrix. His basic pay is ₹44,900, but as he is at Stage 4, which matches the ₹49,000 index in the pay matrix (check our pay matrix calculator below), we need to edit the default ₹44,900 outputted by the calculator and replace it with ₹49,000. Now, select a fitment factor, say 2.2. The updated basic salary under the 8th CPC in this case would be calculated as:

₹49,000 × 2.2 = ₹107,800

Since the DA becomes zero after pay revisions, leave that field as it is. Then, refer to your current salary slip under the 7th CPC for accurate values of HRA, TA, allowances, qualification pay, etc., and, if needed, modify the related input fields.

Other assumptions:

HRA= 27% ( X city) of ₹107,80 = ₹29,106, TA = 3600, Total Allowances: ₹5,000 & Qualification Pay: ₹0.

Once you update all input fields, the Calculator will generate your revised salary (in real-time), based on your level and values you have added, as shown in the screenshot.

Sum of all components or Total Pay under 8th CPC: ₹107,800 (updated Basic) + ₹29,106(HRA)+ ₹3,600 (TA)+ ₹5,000 (Allowances) = ₹145,506.

Gross Salary projection considers the fitment factor added by the user and other relevant components of the CTC.

And if the option is selected, it will also display the increase in salary. Click on the Enter Current Gross Salary checkbox in the calculator UI, and enter your current salary as per the 7th CPC, e.g., ₹105000. The calculator will immediately update the results area with: “Your salary will increase by ₹40506.00 and by 38.58%,” assuming you have entered the values for the calculation we discussed earlier.

The result section also displays the In-Hand Salary, calculated after deducting TDS under the New Regime (2025-2026 slab and rules). It also offers a detailed breakdown of the NPS, which is the mandatory 10% contribution for all employees, along with deductions for the Central Government Health Scheme (CGHS) and the state-specific Professional Tax.

How to calculate 8th CPC fitment factor? here’s what we know so far.

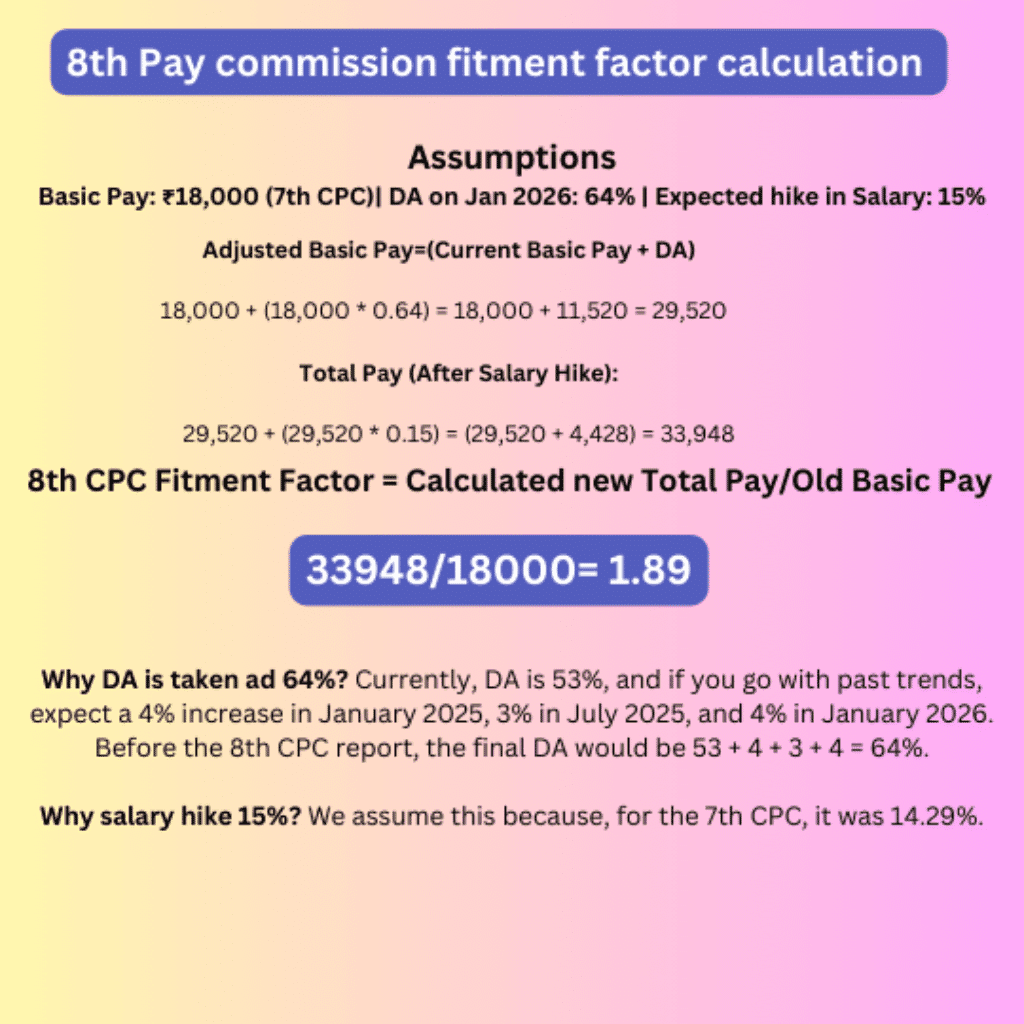

Expectations surrounding the 8th CPC fitment factor have been a hot topic of debate for a while, with many people predicting the multiplier be above 2.00. However, our calculations based on data suggest otherwise.

With the DA reaching only a maximum of 64% by January 2026 (according to historical trends) and an overall expected salary increase of 15-20% this time, the fitment factor decided by the 8th Pay commission may not even cross 2.00. It would be around 1.89, assuming a 64% DA and a 15% salary hike (the 7th CPC had a 14.29% hike on adjusted basic pay). However, it could cross the 2.00 mark if the 8th CPC gets approval for a general hike of 22% or more from the Government.

You can try the following fitment calculator app if you believe the Pay Commission will consider a higher DA or propose a better general salary increase than the 7th CPC.

8th CPC Fitment Factor Calculator

Fitment Factor:

1.89

The idea behind the term “fitment factor” comes from the action of “fitting” an existing salary structure (basic pay + DA) into a revised pay scale during a pay commission’s implementation—in this case, the 8th CPC. It act as a multiplier that adjusts the pay index across all levels of employees and pensioners.

While devising a fitment factor, the existing Dearness Allowance (DA) is merged with the basic pay. By doing so, the current DA becomes zero. Also, the Pay Commission, in consultation with the government, decides on a general salary increase—usually around 10-20% or even more. For example, during the 7th Pay Commission, the DA and basic pay were merged, and a salary hike of 14.29% was added. This hike percentage is then applied to the merged DA and basic pay to calculate the fitment factor.

Here’s a pictorial explanation to help you understand how we arrived at the fitment factor of 1.89 for the 8th Pay Commission.

The fitment factor can be determined using any pay scale (here, we use 18,000). Once finalised, it is uniformly applied across all 18 pay levels, at all stages, to derive the new salary structure. For instance, a fitment factor of 1.89 means the new basic pay will be 1.89 times the existing pay in a particular index.

Pay matrix calculator: Find 8th Pay commission salary increase across each index level.

One can calculate the Basic Pay levels of the 8th CPC and the corresponding Pay Matrix from the existing 7th CPC data once the fitment factor is finalised and approved by the Central Government. However, as the real fitment factor is not available yet, we make presumptions here.

And here is an 8th CPC Pay Matrix Calculator if you have already decided on a fitment factor based on your projections. Change the fitment factor values to see various scenarios.

8th CPC Pay Matrix Calculator

Calculate the pay matrix dynamically by entering a fitment factor.

| Pay Level | 7th CPC Pay | 8th CPC Pay |

|---|

How it works? Let’s consider Pay Level 1 (of the 7th CPC), which has a starting Basic Pay of ₹18,000. Now, apply a suitable fitment factor of your choice, say 1.89, the new basic pay in this case would be, ₹18,000 × 1.89 = ₹34,020. Similarly, apply this multiplier (1.89) across the Matrix, and you will get the results (8th Pay commission salary structure) as shown above in the app.

How to estimate the revised pension under 8th CPC?

Retired central government employees who were part of the Old Pension Scheme (OPS) that existed before 2004-2005 will benefit from the implementation of the 8th Pay Commission. To estimate their pay, pensioners will need to know their current Basic Pension (as revised under the 7th CPC) and apply the fitment factor determined by the 8th pay commission.

8th Pay Commission Pension Calculator

Projected Pension: ₹0.00

Enter the relevant values in the 8th Pay Commission Pension calculator above to estimate your projected pay. Dearness Relief (DR) will reset to zero after 8th CPC implementation as it gets adjusted with the Basic Pension, and it will remain zero until the next DR revision. Apart from DR, Central pensioners are also eligible for allowances, which have been included as optional inputs in the calculator, as they may not apply to everyone. Pensioners aged 80 years or older are entitled to additional benefits ranging from 20% to 100%, depending on their age bracket, which is applied to the adjusted basic pension logic in our calculator app and will be auto applied when applicable.

Frequently Asked questions (FAQs)

The 8th Central Pay Commission (8th CPC), is an interim panel constituted by the Union Government of India. Its primary role is to review the salary, allowances, and pension of central government employees and pensioners, and to suggest a pay rise from current levels. This committee will determine a fitment factor after evaluating the present pay structure of employees, and use it to calculate their future basic pay. The commission will also examine and revise allowances (e.g., House Rent Allowance, Transport Allowance, etc.) to address ongoing inflation rates and financial conditions.

There is a general practice of setting up a new pay commission every 10 years and the announcement on January 16, 2025, continues this tradition. The last CPC was established in 2014 and it submitted its recommendations in 2015. The 8th CPC could also spend about a year finalising its conclusions, possibly by early-2026. If the cabinet approves the commission’s proposals, the revised pay scales could be implemented retroactively from January 1, 2026 with with employees getting arrears for the period between January 1, 2026, and the date of implementation.

It is believed that there will be an overall increase of 80-120% in Basic Pay, and this could be true. However, it is also important to understand that this includes merging DA with your existing pay. The actual increase in salary would be only 15-20%, which is yet to be decided by the commission. That said, if Basic Pay increases by 100%, it will affect the calculation of HRA and other allowances, causing compounded benefits and a significant increase in your Gross Salary.

8th pay commission approval by the Central government is good work which boosts the purchasing power of 65 lacs pensioners and 40 lacs Central government employees.

Fitment may increase pension also increased

Requesting you to remove ₹3,000 as the default Qualification Pay and ₹9,000 as Allowances Pay in your calculator and set them to zero by default. The majority of government employees do not receive such high allowances, and Qualification Pay is not always applicable. Overall, it’s great work—none have provided all 8th pay commision calculators in one place, espcially gross salary, net salary and tax implications. Kudos, and keep up the good work!

NICE

Where I am gonna get these information there is no info of these things in ppo slip