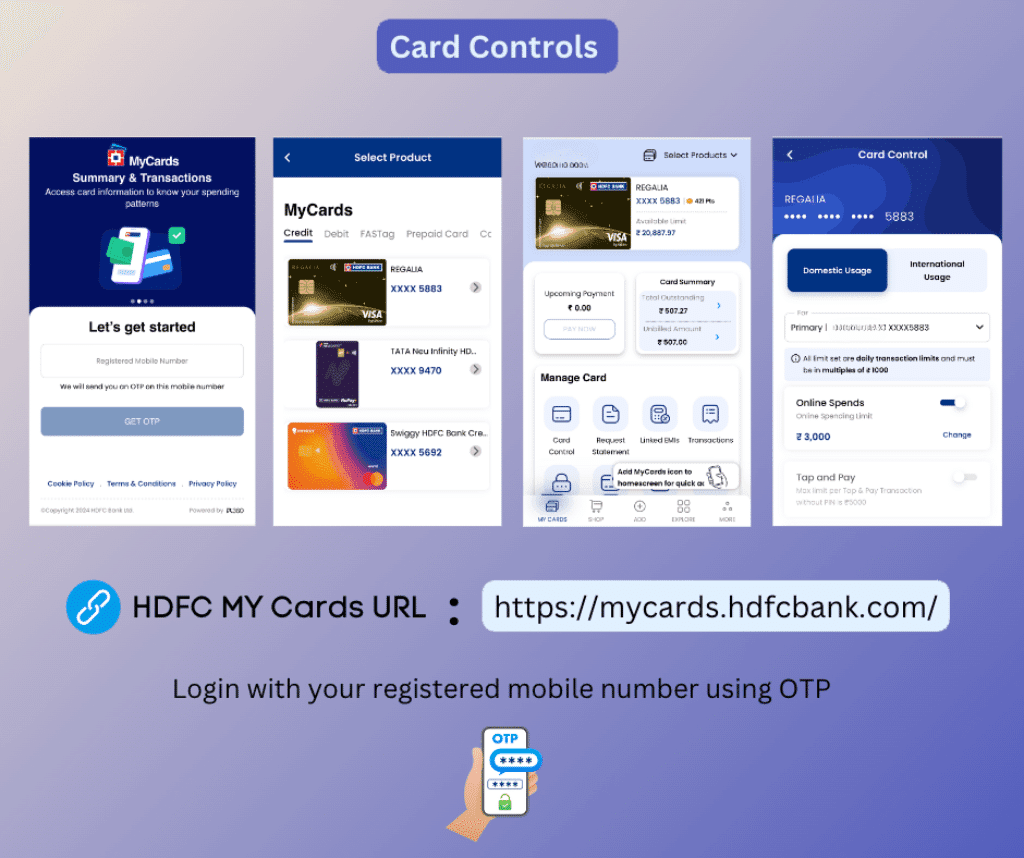

HDFC MyCards: Control Card Settings via the web app at mycards.hdfcbank.com

HDFC MyCards is a web app from HDFC Bank that allows customers to view summaries of their cards (Credit, Debit, FASTag, CDL), and control their settings on the go. It works on any mobile device without the need for installation or activation. Whether you need to quickly activate or block a card, reset the PIN, set transaction limits, check loan statements, and more, simply click the button below to log in and get it done with MyCards.

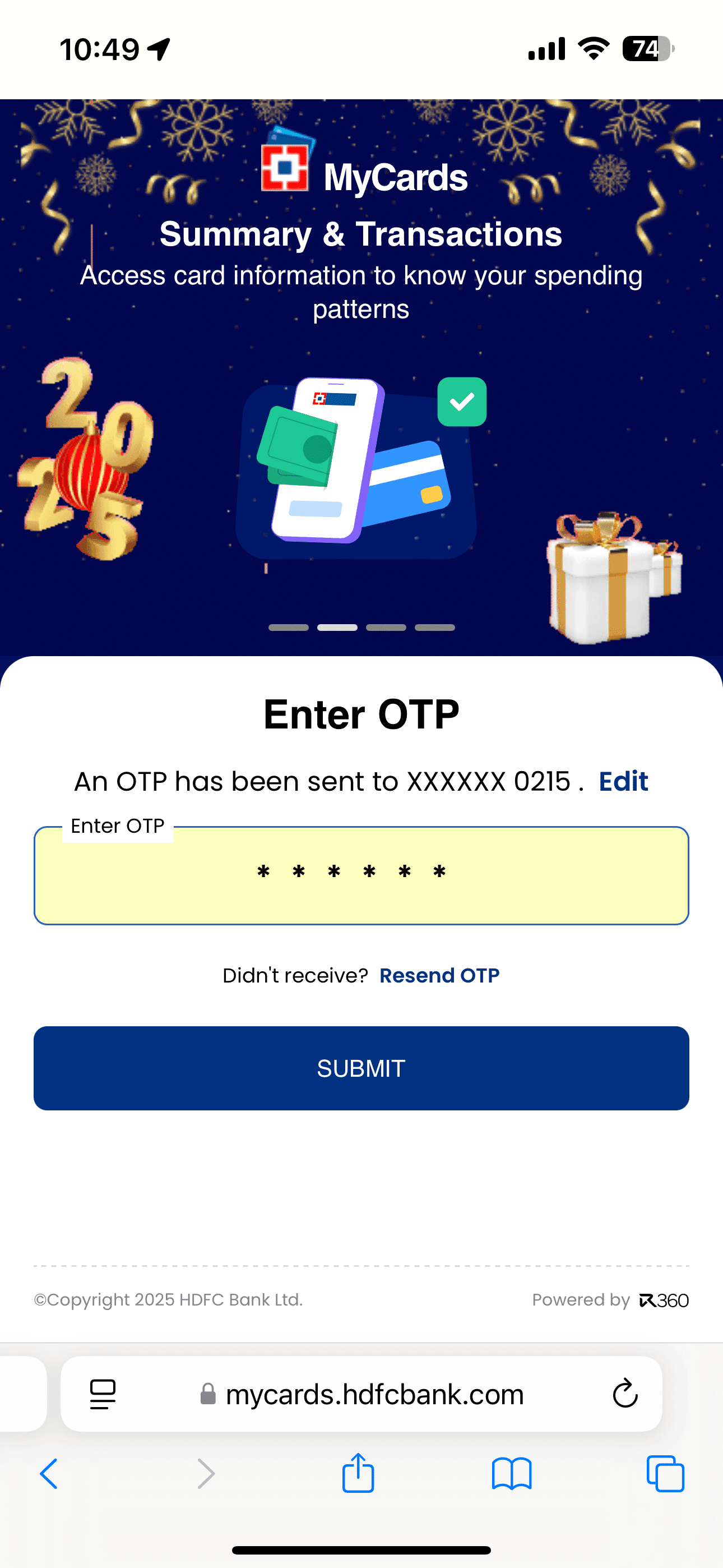

Customers have three options to login to the MyCards app: click the button below, scan the QR code, or visit mycards.hdfcbank.com using a mobile browser. Then, use their HDFC Bank registered phone number to generate an OTP. After logging in, add details of the HDFC Credit Card, Debit Card, Prepaid Card, Consumer durable loan Card, or FASTag to access individual product settings.

When HDFC Bank launched Mycards, it was possible to sign-in to the app through desktop browsers, but this feature has been disabled as of 2025. Hence, make sure you use a mobile browser to access the above link.

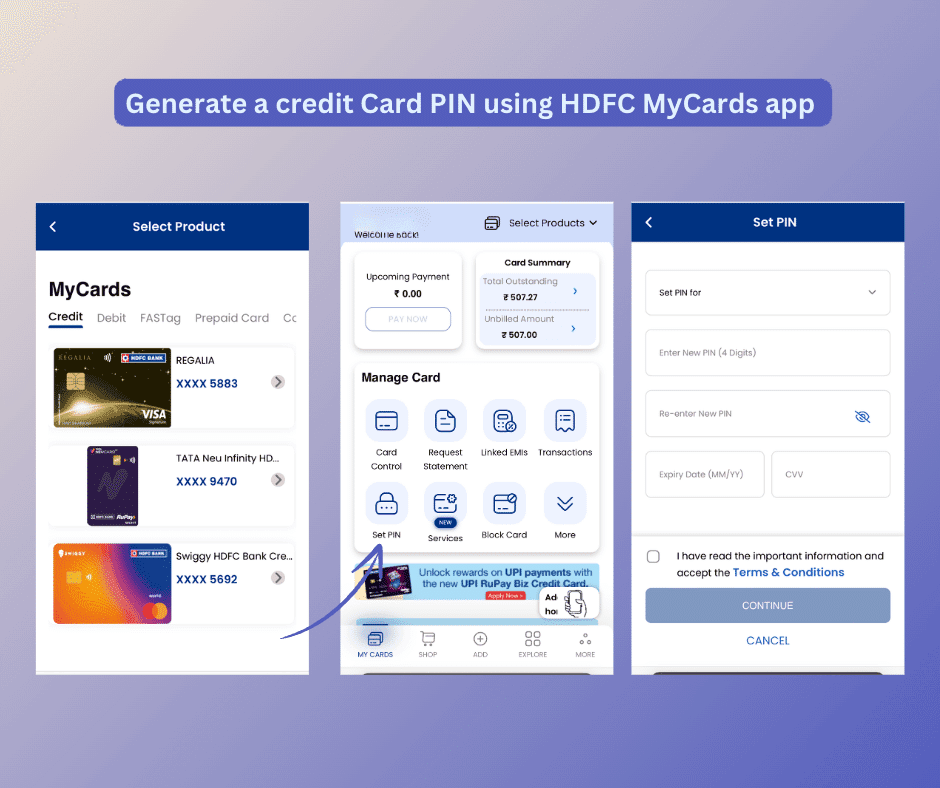

MyCards can be used to activate your new HDFC Credit and Debit Cards. First, add the card as explained below, and tap on it when it appears in the app, to open its summary. Then, click on the ‘Set PIN’ icon, enter the card details, choose a new PIN, and submit it to activate the card instantly.

Managing HDFC Bank Credit & Debit Card settings using My Cards app

Managing a card account has become more hassle-free with MyCards by HDFC Bank. Here is how to start using the product.

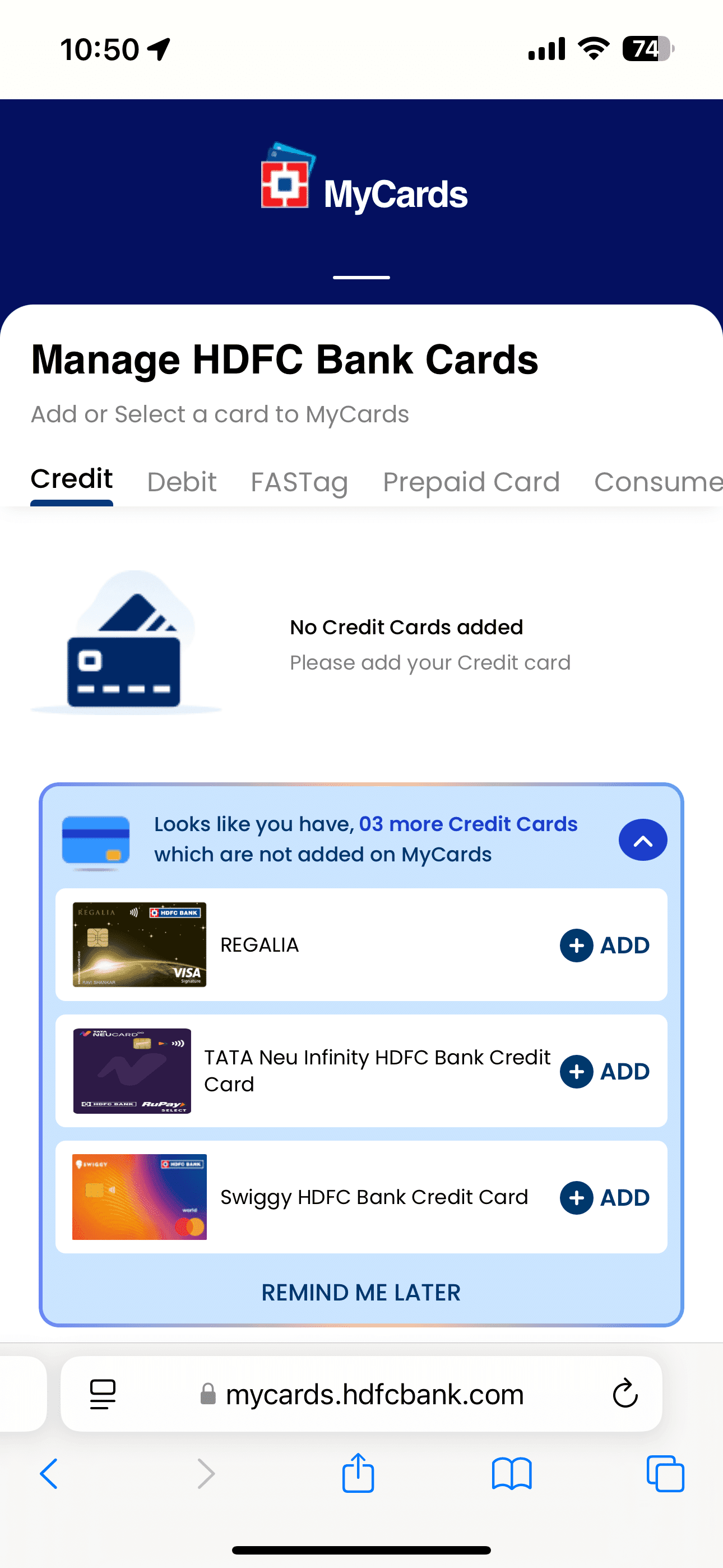

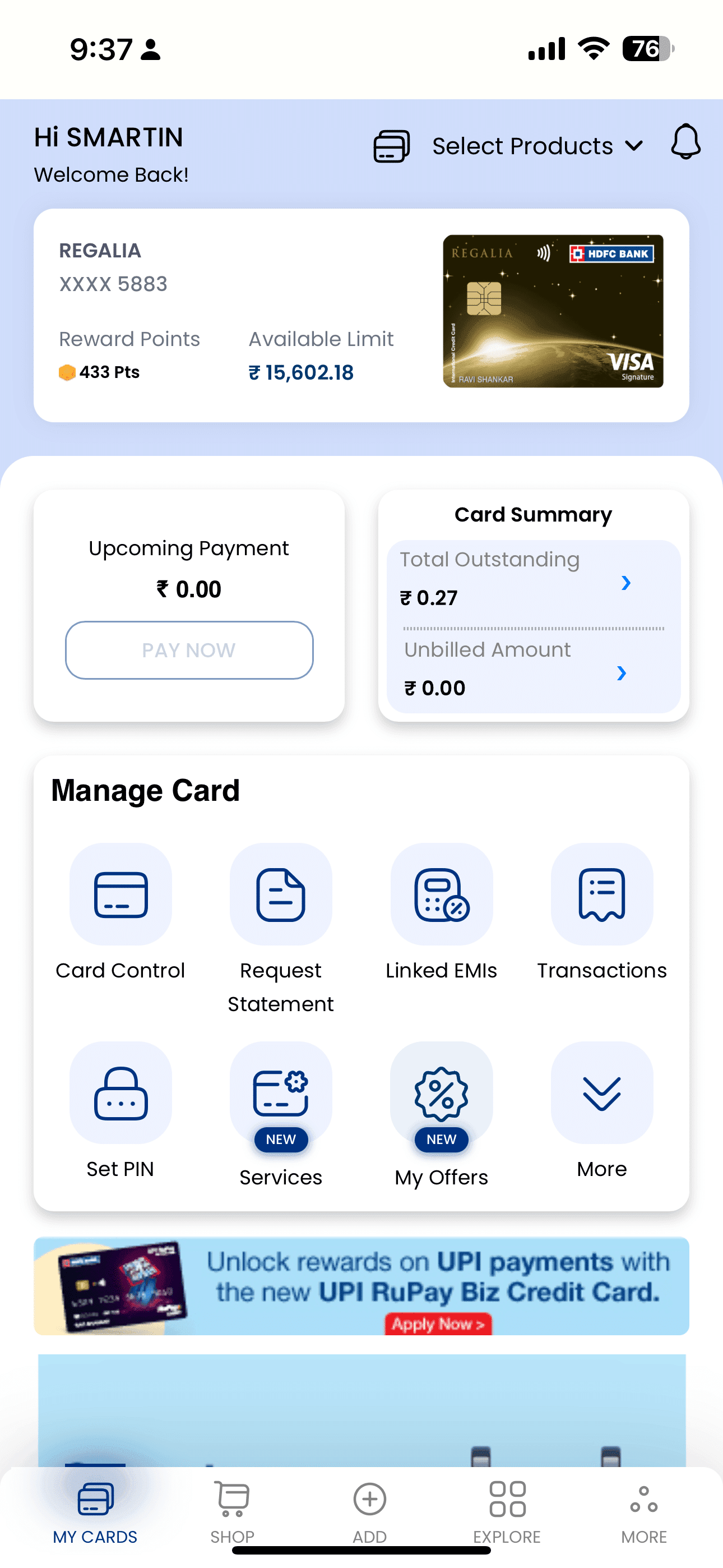

When you log in to HDFC MyCards for the first time, the home screen will already be populated with the credit cards you have. If not, and you want to add a different product manually, follow these steps.

- Login to the app at mycards.hdfcbank.com

Enter your phone number associated with HDFC Bank on the login window, and sign in to the My Cards App using OTP verification.

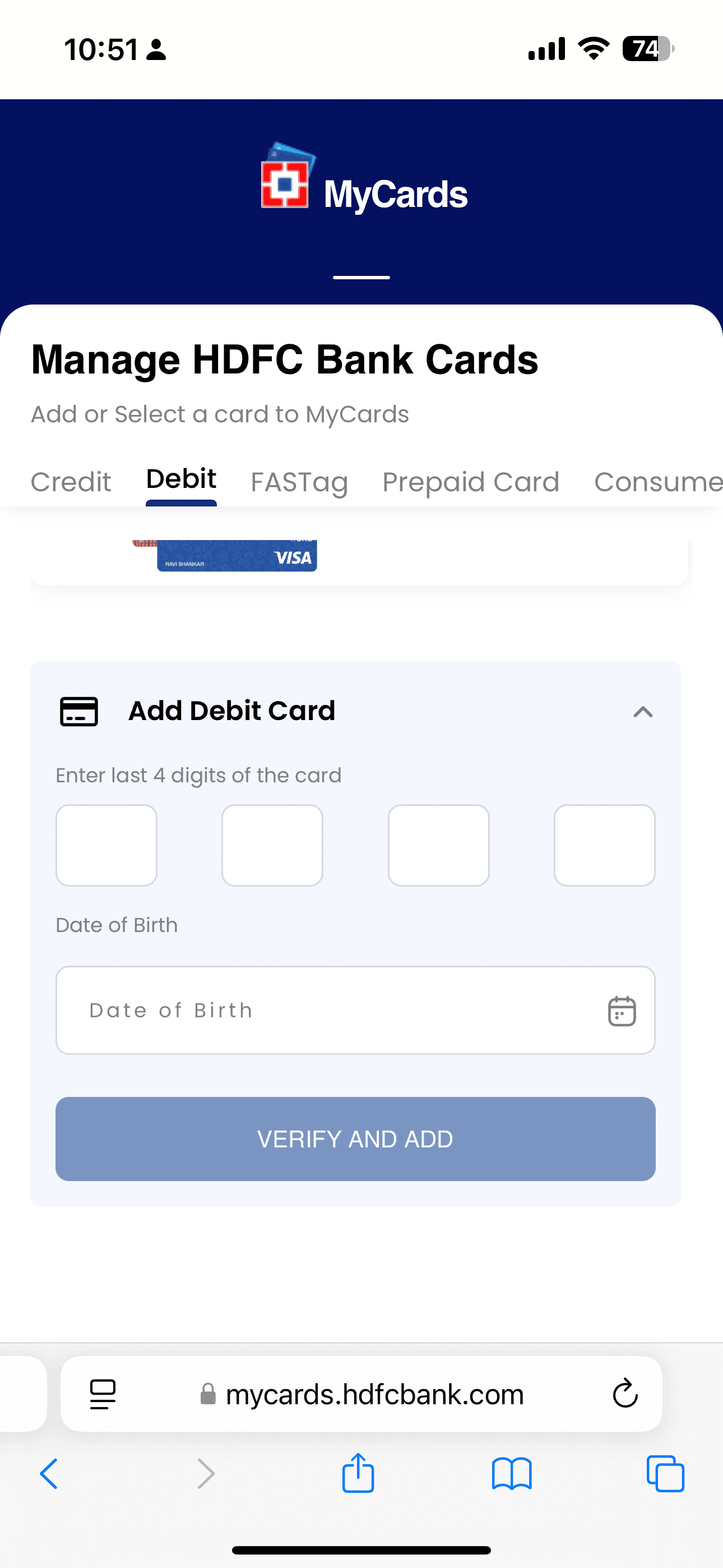

- Pick a card type: Credit, Debit, Prepaid, CDL or FASTag

Once you login, find the scrollable tabs below the ‘Manage HDFC Bank Card’ heading. Tap on the card type you want to manage. By default, on launch, you will be in the Credit Card section. However, if you want to access Debit, FASTag, Prepaid Card, or Consumer Loan, click on the relevant tab.

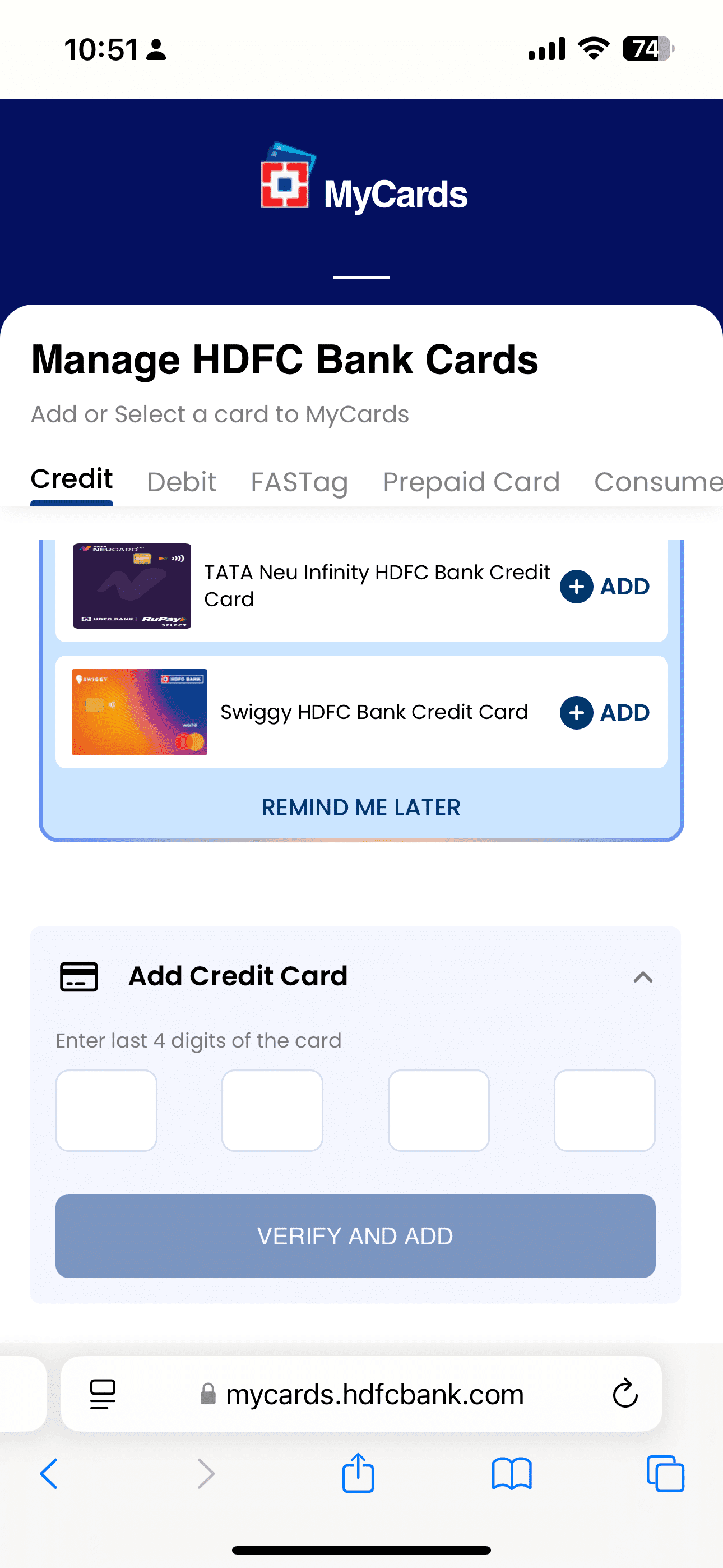

- Add a Credit, Debit or Prepaid card

To add a credit card, if it is not already present, click on the ‘Add Credit Card’ strip at the footer of the MyCards home screen and enter the last four digits of the card, then press the ‘Verify and Add’ button. In the new version of HDFC MyCards, it will auto-detect your un-added cards, and you will also see a prompt asking you to add it—tap on the add icon to do so. You may also choose to add a debit card or prepaid card by providing the last four digits and, additionally, your DOB (for debit cards only).

- Manage FASTag or Consumer Durable Loan Card

FASTags and Consumer Durable Loan cards can also be managed through HDFC MyCards, but they cannot be added manually. For these products, if you already maintain a relationship with HDFC Bank, they will be pulled automatically and displayed under the corresponding section.

- Select a card to access details and control it’s settings

When you add your cards, each one of them will be stacked in the HDFC MyCards UI. You can easily view the Summary and manage card-specific settings by simply clicking on the respective row. If you want to switch to other cards in HDFC MyCards while on an individual card page, click the ‘Select Products’ menu at the top-right corner.

What is HDFC MyCards? Is it a credit card app?

HDFC MyCards is not just a dedicated credit card app; rather, it’s a platform to manage selected HDFC Bank products in a simplified way. It differs from a mobile app from both from a technical standpoint and in various aspects. While the HDFC Mobile Banking app requires device activation with a user ID, debit card number, etc., on each device, MyCards doesn’t need any. Instead, you can install it on your phone as a web app.

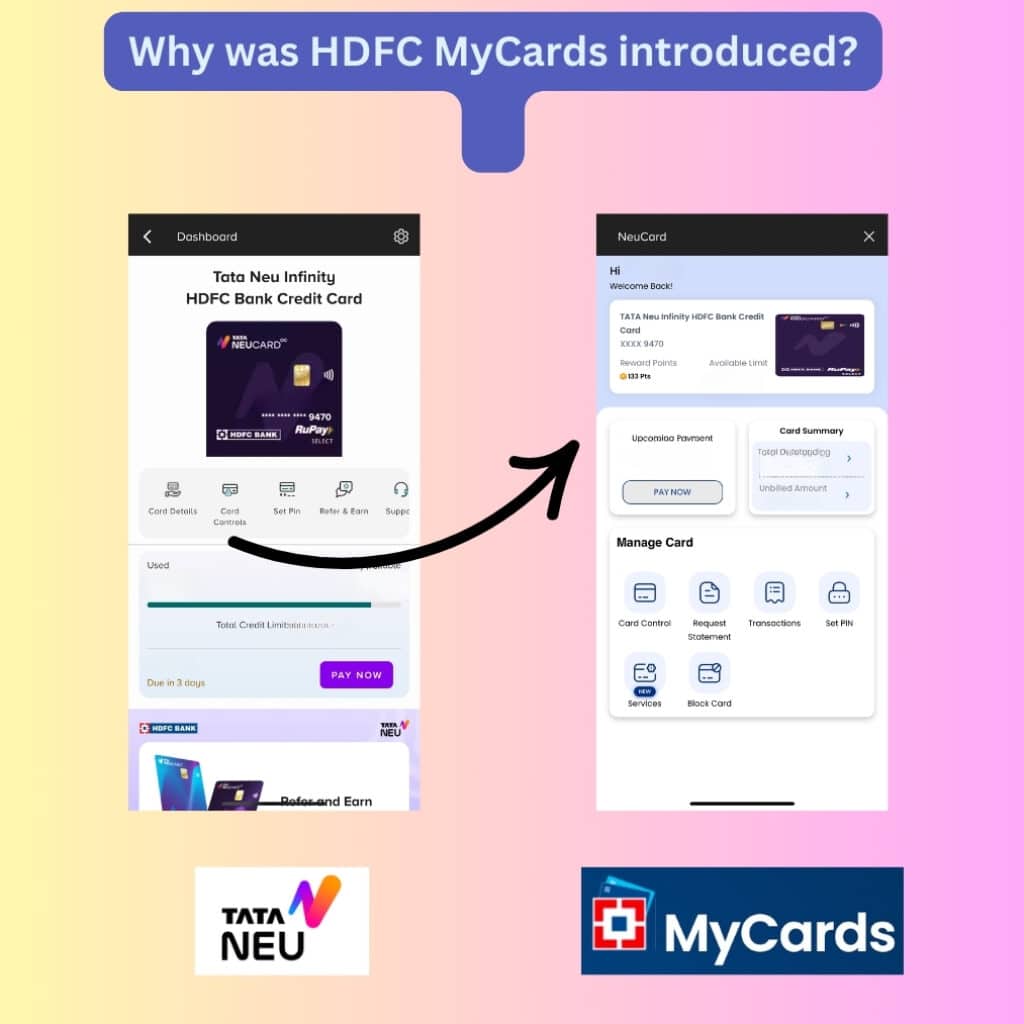

HDFC Bank already has a well-functioning mobile banking app – so why did they bring in the my cards web app? Here are some reasons behind this decision.

1. Co-branded Card Control: In 2022, the Reserve Bank of India (RBI) issued a directive to banks and fintech companies prohibiting them from providing card-control settings in third-party apps in any way that shares or exposes customers’ sensitive information. As a result, platforms like Tata Neu, which previously allowed customers to manage their co-branded HDFC credit cards directly within the app, have integrated these features into the HDFC MyCards app.

Now, when customers click on “Card Control” for their Tata Neu HDFC credit card within the Tata Neu app, they are redirected to the HDFC MyCards app through deep-linking without affecting the user experience. Users won’t even realise that the settings option is being displayed within MyCards. This approach complies with RBI regulations on security and wouldn’t have been possible without launching the MyCards app.

2. Easy Card Activation: These days, banks make instant decisions when you apply for a credit card. For HDFC Bank, once a credit card is approved after their quick online checks, it is immediately gets added to the MyCards app, and an activation link is sent to customers through SMS. The card can be then activated instantly by following the link (which opens mycards.hdfcbank.com) and setting a new PIN. I observed this process myself while applying for my Swiggy HDFC Credit Card.

3. Fast OTP-based login: With MyCards, HDFC Bank provides a quick and efficient way to disable a card or manage transaction settings without needing to contact customer care or access the mobile app. At the same time, installing and setting up the official app may require additional authentication, such as account details, debit card information, or other banking credentials (if it hasn’t been activated on your device for some reason), which might not always be readily available in urgent situations.

Things you can manage with HDFC MyCards app

1. HDFC Credit Card Control settings available on MyCards

- Activate a new HDFC Bank credit Card.

- Check the summary of transactions on all HDFC credit cards.

- Linked EMIs: View existing EMIs and their status.

- Card Control: Enable or disable online & offline payments, including tap & pay, international transactions, and ATM withdrawals.

- Check billed amount and download the credit card statement (PDF).

- Cancel, block and reissue a card.

- Change credit card PIN number.

- Rewards points: View rewards points and redeem them (externally).

- Change credit card billing cycle (suspended for now).

- Apply for a new UPI credit card/Add on Cards.

- Check limit, enhance it, and also upgrade the card if eligible.

- Card token management.

2. Debit Card management options.

The Debit Card section on HDFC My Cards is not on par with the Credit Cards in the feature list. Most of the functions don’t work natively, instead, they are just hyperlinks. For example, if you want to set a PIN, it will redirect you to another HDFC website to complete the action. However, MyCards works well for crucial debit card preferences such as blocking and transaction controls.

- Enable or disable Domestic, International usage, ATM withdrawal, Merchant transactions, and Tap & Pay. Also, set limits for each transaction.

- Instantly block the debit card.

- View the status of Debit Card EMIs and loans.

- Set a new debit card PIN (link to HDFC Insta service website).

3. FASTag.

- To view your HDFC bank issued FASTag’s balance and vehicle information.

- Access to latest transactions.

- Option to reissue the Tag and recharge the wallet (link).

4. Consumer Durable Loan (CDL Card).

- Loan account Statement: View current status, past transactions and remaining dues.

5. Prepaid Card Services.

- View the summary and balance of your HDFC Bank GiftPlus, Forex, Millennia, MoneyPlus, and other prepaid cards.

- Change the PIN.

- Set prepaid card usage limits and even block or unlock the prepaid card.

How to Install HDFCMyCards App on a Phone

HDFC Bank has had a mobile app (iOS & Android) for years. However, customers without a savings bank account have had to rely on HDFC’s credit card net banking to manage and control their card features. Most customers now use mobile devices, so it is no longer a reliable solution. With the introduction of MyCards, HDFC Bank credit card customers have greater convenience.

As a Progressive Web App (PWA), HDFCMyCards can be installed on both Android devices and iPhones without using the App/Play Store. Open default browsers, Safari (iOS) or Chrome (Android) on your phone and navigate to the My Cards Portal. On iPhone, click the Share button, then select ‘Add to Home Screen.’ On Android, tap on the three dots (Menu) in the upper right corner, scroll down, and click ‘Install app.‘

Once installed, MyCards app icon will be added to your phone’s springboard, as shown in the screenshot. From now on, you can click on this icon to quickly manage all your cards.

FAQs on HDFC My Cards

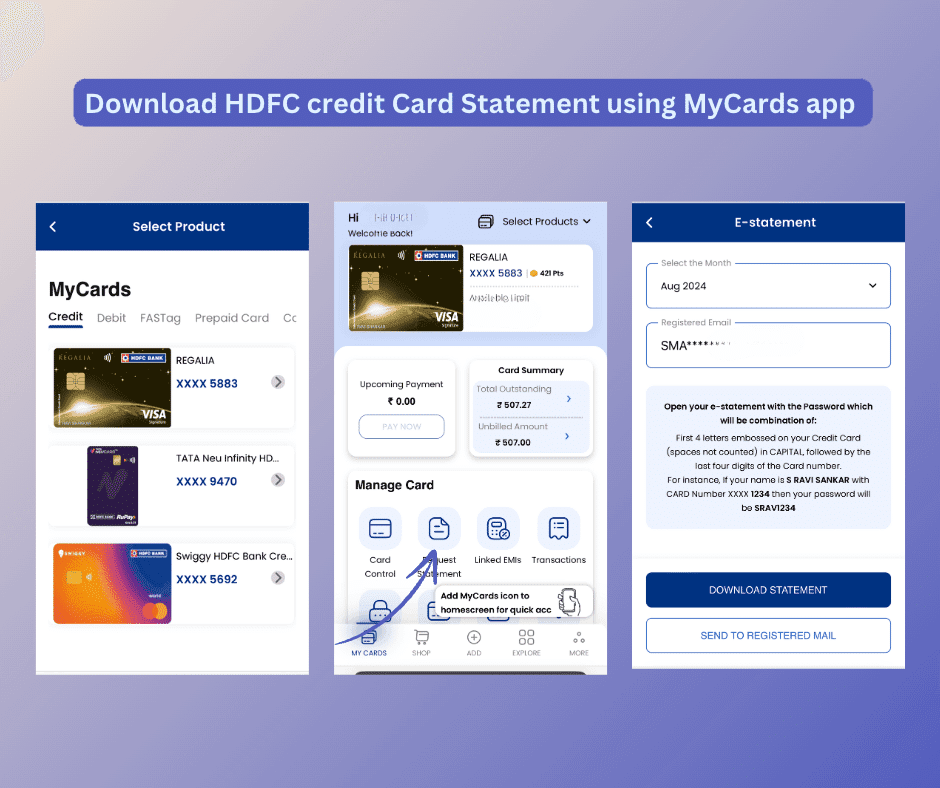

MyCards is your saviour; this app lets you download the original digitally-signed HDFC credit card statement (PDF) without net banking credentials. Just provide your phone number to sign in to My Cards. Then, click on the ‘E-Statement‘ icon on a card’s home page. Next, select the month, enter your email, and click on the button to download the statement.

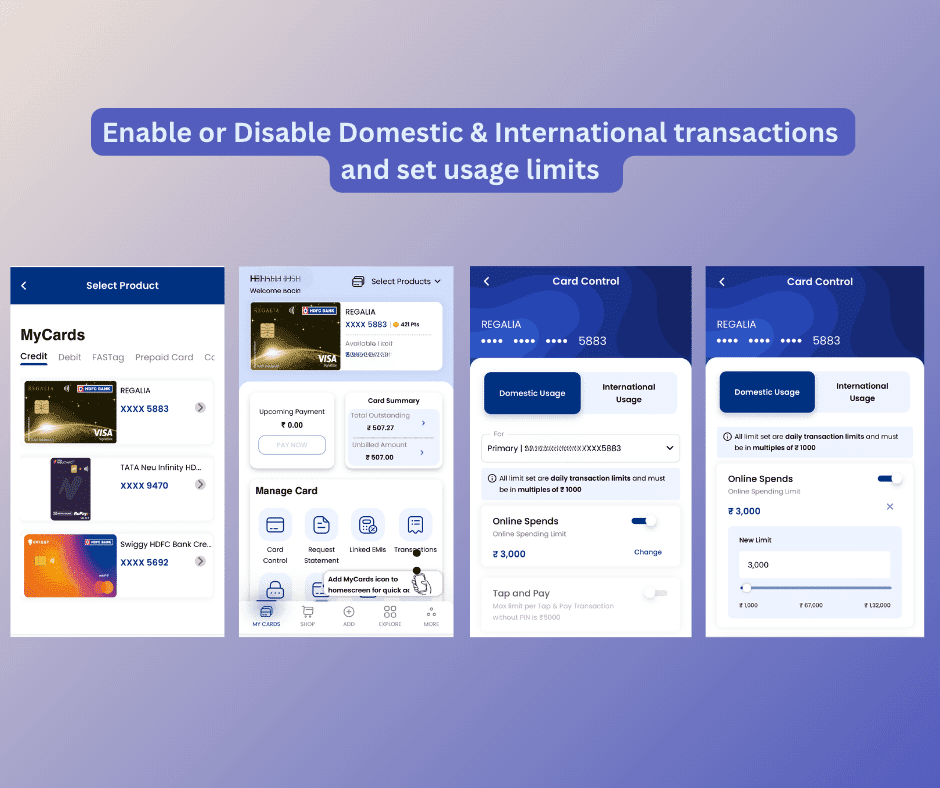

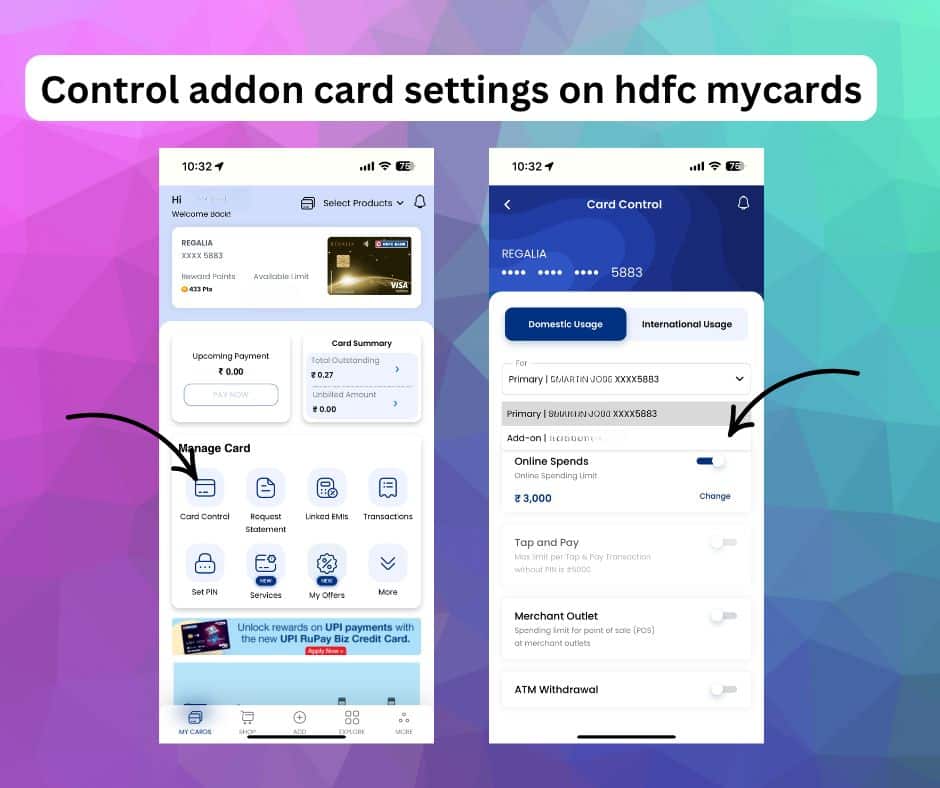

Select a credit card from the HDFC MyCards app’s home screen. This will open a dedicated section for the selected card. From there, click on the Card Control icon. As shown in the screenshot, you will find a ‘Change’ link for the transaction types that are currently enabled. Click on it, and you will see a slider and an entry field where you can specify your desired spend limit.

Options include the ability to disable international, local, and merchant transactions, as well as ATM withdrawals and NFC Tap & Pay. You can also limit the card’s overall limit and set per-transaction limits. Each type of transaction can be toggled on and off using slider controls. Click the “Change” label to set or change limits. Then, input your new upper limit and click the ‘Update‘ button.

Login to HDFC MyCards, Select a card, and scroll a bit down to find a ‘SET PIN‘ option on the second row of the under “Manage Card” section. Click on that, then input the desired PIN twice, card expiration date, and CVV. Click ‘Continue,’ and an OTP will be triggered. Verify it, and you will see an on-screen message confirming that your new PIN has been changed/generated successfully.

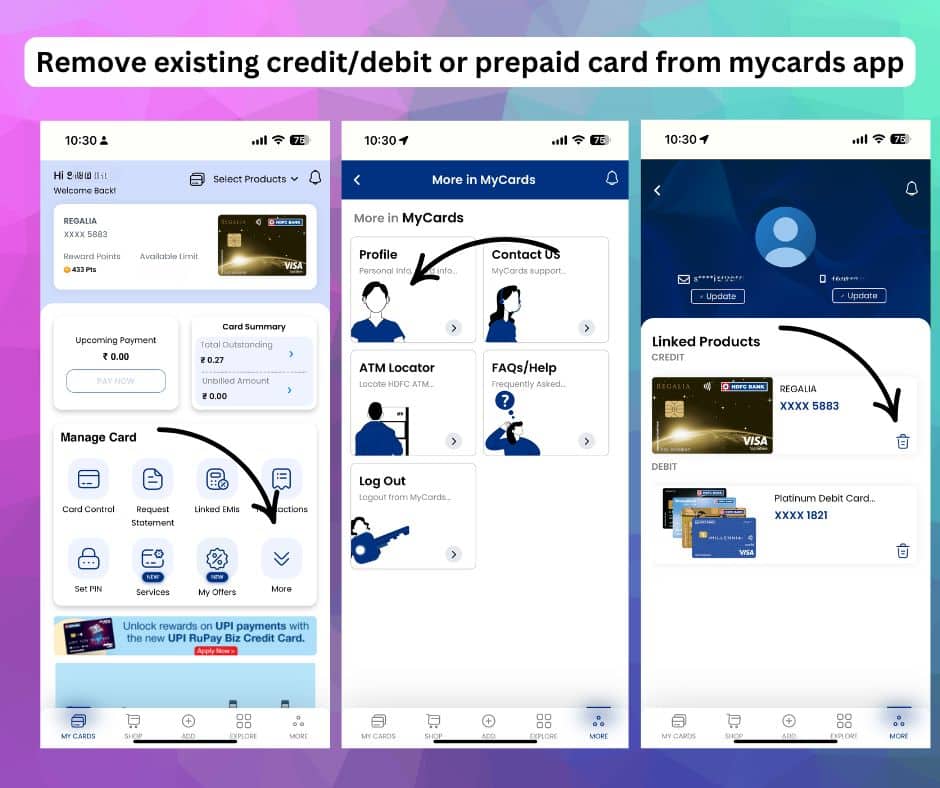

Yes, you can remove already added products (cards, loans, and FASTag) from HDFC MyCards by going to ‘My Profile.’ To access ‘My Profile,’ open the summary of any added product, such as a credit card. Then, click on the ‘More’ tab at the right corner of the footer row of the app. Select ‘My Profile’; here, you will see a list of ‘Linked Products.’ Next, click on the delete button next to the chosen card to remove it from MyCards.

Addon cards can be managed from the ‘Card Control’ section of the My Cards app. Click on the drop-down menu labeled ‘For‘ near the middle part of the app, as shown in the screenshot. You’ll see the addon card and the holder’s name; pick it to access its controls.

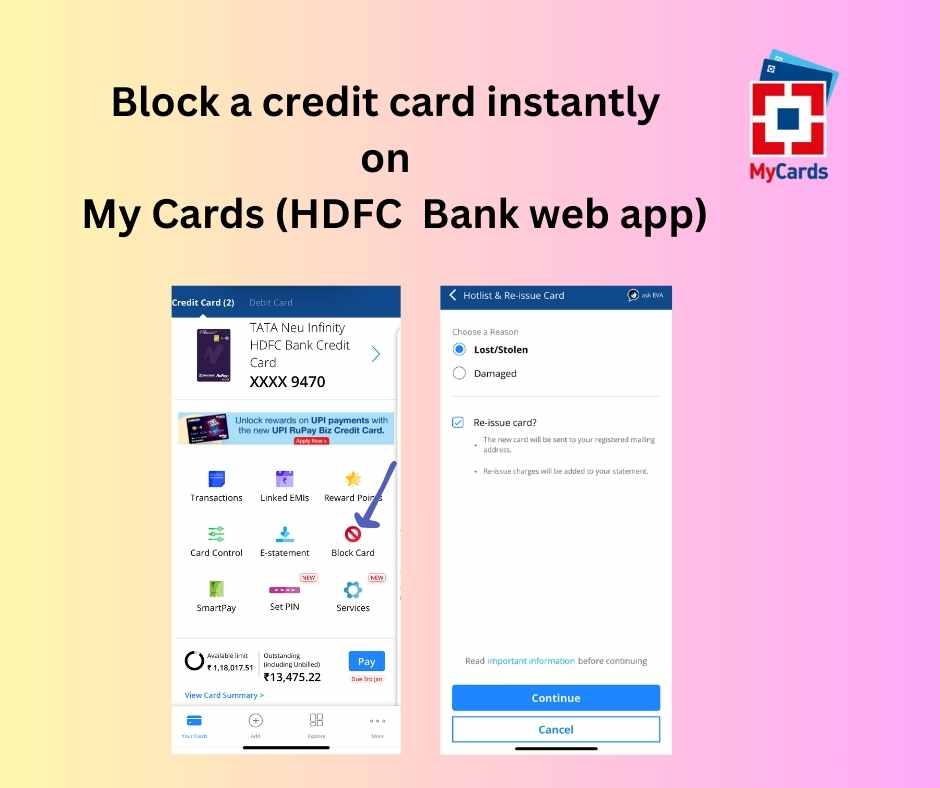

If you want to block your card, HDFC MyCards is the quickest way to do so. Logging into HDFC MyCards and hot-listing a lost or stolen credit card takes less than 30 seconds. Once you are on a specific card’s listing page, locate the ‘Block Card‘ icon, then select either ‘Lost/Stolen’ or ‘Damaged.’ You also have the option of re-issuing the same card.

MyCards is a PWA and should be accessible across all devices, but recently, the developers have limited its availability to mobile browsers. Hence, you won’t see a login option if you open the official website link in desktop mode. I’ve confirmed that user-agent switching doesn’t work in 2025 either. Now, if you are facing issues with OTP generation and slow loading, understand that it’s a temporary delay with HDFC’s digital infrastructure, which is very common. We cannot do much about it except wait for a few hours, and if it’s urgent, try other channels like the mobile app or customer care.

Conclusion:

MyCards is an impressive attempt from HDFC Bank and one of its most practical product launches in recent times. The release of the HDFC MyCards app partially fulfils the long-standing demand from HDFC Bank customers for a dedicated credit card app. It also serves as a platform to manage debit cards, loans, and even FASTags. While some features in the MyCards app don’t provide a fully app-like experience (which is understandable since it’s a PWA), it is a faster and better alternative to the traditional mobile app. It would be even better if the bank reinstates certain helpful features—such as the ability to change the card cycle and desktop compatibility—which have been removed from MyCards.

App not working

This new web app looks like a game changer! The ability to control my HDFC cards from one platform is so convenient. I love the focus on security features too. Can’t wait to give it a try!