IGST on credit card: What are charges like IGST VPS RATE, DB @18.00, CI@18, etc.?

Credit card statements sometimes show strange transactions like ‘IGST-VPS-RATE-18 (HDFC)’, ‘IGST CI@18 (ICICI)’, ‘IGST DB @18.00 (SBI)’, or even ‘IGST 18’. When you see it for the first time, you may wonder, ‘Why is the bank charging me?’ Yes, IGST, which stands for Integrated Goods and Services Tax, is applicable on certain credit card transactions and EMIs. Here is how it is calculated and the rules surrounding it.

IGST 18 charges on a credit card bill is a tax deduction that was collected and paid to the government by your credit card issuer. Currently, the GST rate for most financial services, including credit cards, is 18%, which is why these transactions are often labeled with the number 18 and reflected on the monthly statement. The IGST 18, or Integrated GST, collected is then split between the State where the transaction occurs and the Central Government as CGST and SGST.

How to calculate IGST? It’s simple for credit card services—just take 18% of the transaction value. For example, if a credit card’s annual renewal fee is ₹1,000, the corresponding IGST charge will be ₹180. Scroll down to use our IGST calculator– it will help you understand the tax impact on your credit card loans and EMIs.

Transactions for which IGST is applicable on credit cards.

As a general rule, credit card transactions, such as the interest component of monthly EMIs or certain service charges, are chargeable under IGST and taxed at 18% of the transaction value. However, as per the ruling of the Honourable Kolkata High Court, loans offered outside the credit limit, such as HDFC Jumbo Loans, do not attract IGST. The EMIs offered by banks in such cases are inclusive of GST charges. Refer to the table for common IGST charges found in Indian credit card statements applicable to major banks and financial institutions.

| GST charge code | Bank Name | IGST amount charged | IGST charge applicable on |

| IGST VPS RATE -18.0 | HDFC Bank | 18% ( SGST+ CGST) | Credit card annual / membership Fee Joining Fee Cash advance fee Late Fee, EMI processing Fee, reward points redemption fee, Foreign currency (FCY) Mark-up fee. Interest part of finance charges, Insta Loan, SmartEMI, Merchant EMI conversion, balance transfer on EMI, No-Cost EMI, etc. |

| IGST-CI@18% | ICICI Bank | ” ” | ” “ Personal Loan on Credit Card (PLCC), EMI on Call, etc. |

| IGST DB @18.00% | SBI Cards | ” ” | ” ” Encash, Flexy Pay, Easy Pay |

| IGST | Standard Chartered Bank (SCB), OneCard, Kotak Bank, IDFC bank | ” | ” ” Pre-approved Instant Loan/Cash on credit Card, OneCash and other products |

| GST | RBL Card, Axis Bank, Federal Bank, American Express, IndusInd Bank | ” | Charged on interest component of all credit card based loans, and also for all service fee categories mentioned above. |

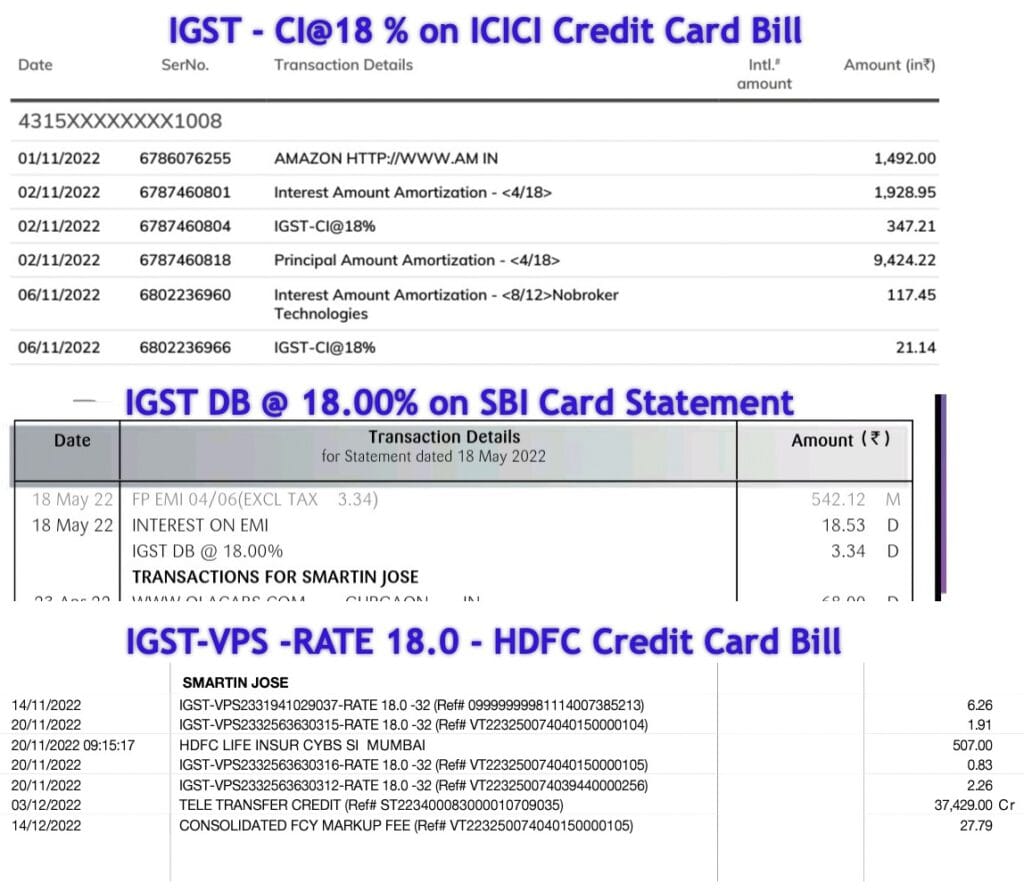

Here we have credit card statements from ICICI Bank, HDFC, and SBI, showing IGST charges in their respective formats. Since the statements do not provide an explanation and only display the calculated IGST amount, customers often find expenses like IGST-VPS RATE 18, IGST CI @18%, and IGST DB 18.00 surprising, especially for those who have opted for schemes like no-cost EMI. Very few people are actually aware that the fees charged for credit card-related services can attract IGST charges.

Most of the time banks do not mention potential tax-related charges in the amount shown during the conversion of online or offline purchases to EMI. These charges only appear on the statement. Here is a video explaining how to calculate IGST 18 charges on a credit card by taking a specific transaction as an example.

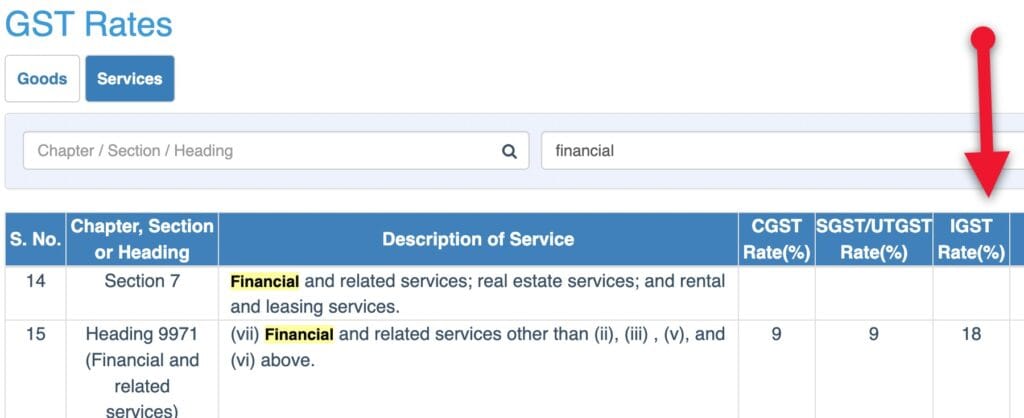

IGST slab for credit cards and Banking services (2025).

It is pretty much evident from the screenshot that as per the provisions of the GST tax regime in India, banks are required to pay 18% IGST on financial services to the government. This is the reason for IGST charges on credit cards.

How to calculate IGST 18 charges for credit card loan or EMI? Use IGST, CGST and SGST calculator.

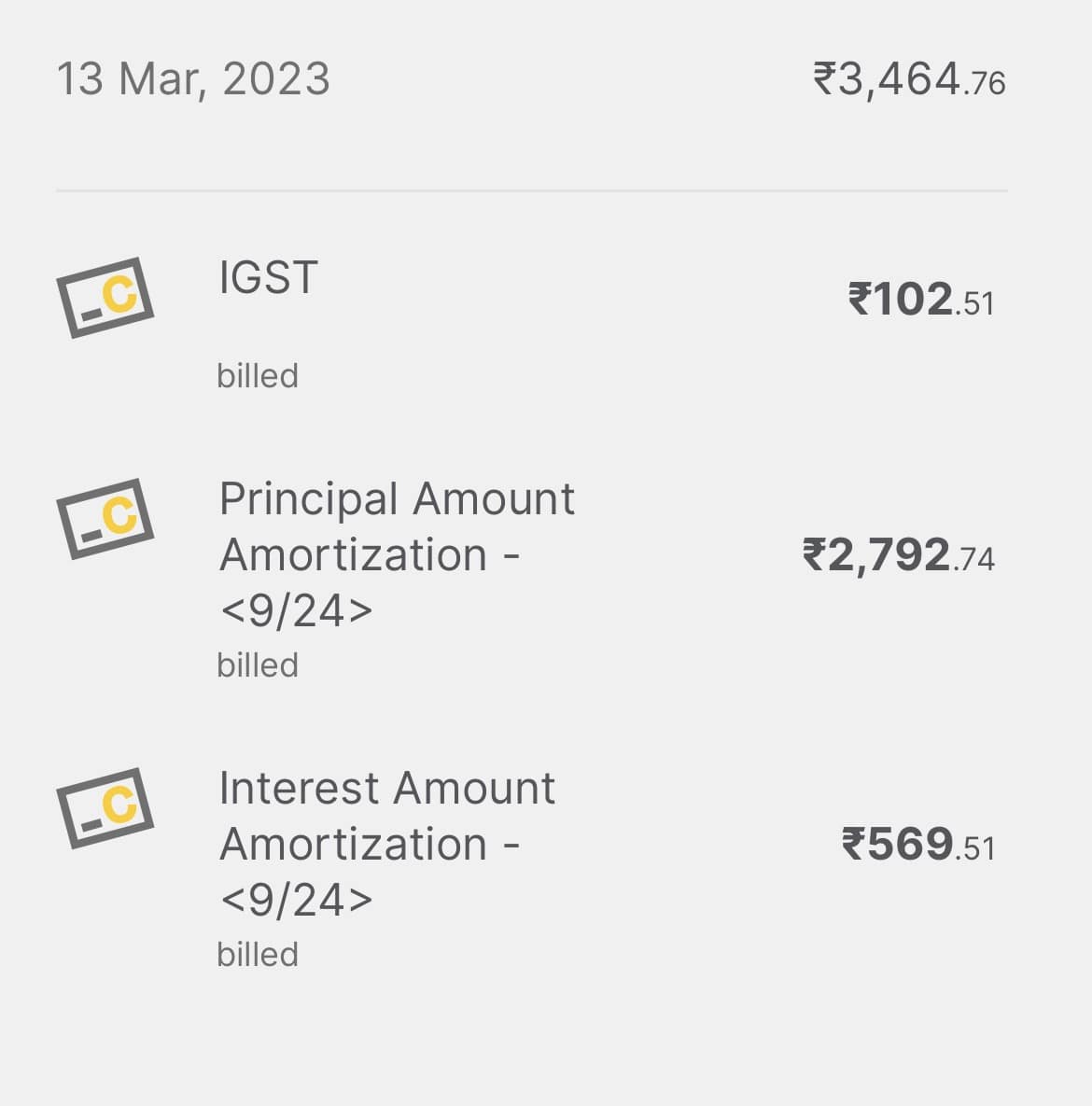

If you want to calculate IGST charges for credit card loans and EMIs, I recommend using the IGST calculator we have developed. It lists your monthly IGST outgo as well as the total IGST charges over the entire loan or EMI term. Enter your EMI or loan details along with the tenure to calculate. You can choose between Flat Rate or Reducing Balance for calculations.

IGST Calculator

Calculate total IGST charges on credit card loans and EMIs.

Results

Total IGST: ₹4320.00

Monthly IGST: ₹180.00

Shared IGST - CGST: ₹2160.00, SGST: ₹2160.00

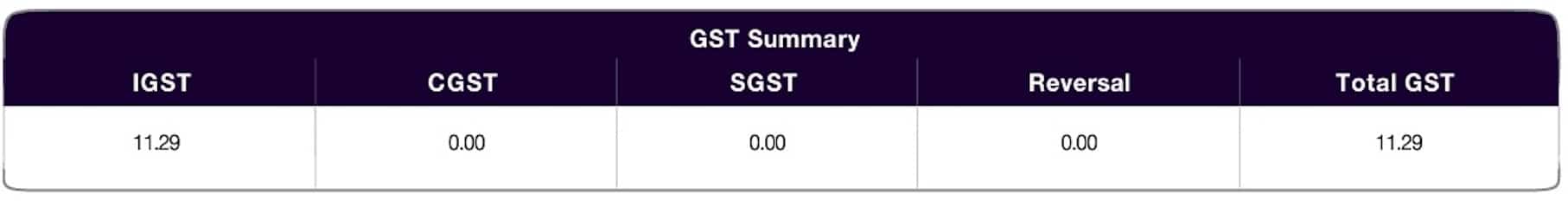

Furthermore, we have included a feature to show how IGST charges on credit cards are shared between the Union States and the Centre, with 9% allocated to each.

Some banks split the IGST charges as SGST (State) and CGST (Central), calculated at 9% each. They display it separately in the credit card bill. However, the total implication for the customer remains the same.

You cannot claim a refund for IGST charges or raise a dispute unless the transaction is cancelled or service fee is reversed.

For No-Cost EMI, the bank only discounts the total interest amount upfront. The GST amount is excluded, and the customer needs to pay it every month, over and above the EMI. Thus, IGST will be added to your credit card will even if the purchase was under no-cost EMI.

You can’t stop getting the IGST charges on your card altogether, but you can try to reduce the payable amount. To achieve this goal, you must stop opting for EMI on credit cards. Also, consider getting a lifetime free credit card. Likewise, if you frequently conduct foreign currency transactions, try acquiring a credit card with low FCY. To summarise, you must get a card with the lowest service charges and abstain from taking EMIs to avoid GST charges.

Banks do these naming at tier discretion, but they are more or less the same thing and indicate the IGST charges at 18%. Sometimes, the State GST Code is added at the end of the IGST transaction. For instance, in my case, for the HDFC credit card statement, it is IGST-VPS RATE -18 -29, where 29 is State Code for Karnataka.